An issuer processor is a platform used by banks to manage credit and debit card transactions, handling authorization, card management, and security.

What is an Issuer Processor:

An issuer processor is a key component in the financial industry that helps banks and credit unions manage their card transactions. Essentially, it’s a specialized service that handles the processing of credit and debit card transactions for financial institutions. This includes everything from verifying transactions to managing cardholder accounts.

An issuer processor is a critical component in payment systems, acting as the bridge between card issuers and transaction networks. It manages tasks like card issuance, transaction approval, fraud detection, and account updates. Modern issuer processors leverage advanced APIs and AI for real-time processing and enhanced security. Their evolution supports seamless digital payments and fintech innovation worldwide.

What is the Purpose of an Issuer Processing Platform:

The main goal of an issuer processing platform is to efficiently manage the financial transactions related to credit and debit cards. Here’s a closer look at its purposes:

- Transaction Authorization: When you use your card to make a purchase, the issuer processor checks with your bank to ensure that your account has sufficient funds and that the transaction is legitimate.

- Card Management: The platform handles tasks like issuing new cards, activating them, and updating your account details. It also manages lost or stolen cards and assists with customer inquiries.

- Data Security: Protecting your financial information is crucial. Issuer processors ensure that your card details are transmitted securely and stored safely to prevent unauthorized access.

What Are the Benefits of Using an Issuer Processor:

Using an issuer processor offers several benefits, making it a valuable tool for both financial institutions and cardholders:

- Efficient Transaction Processing: Issuer processors streamline the way transactions are handled. They speed up the process of authorizing and completing transactions, which means you can make purchases quickly and accurately. This efficiency also helps reduce the costs associated with managing transactions.

- Improved Fraud Detection and Prevention: Advanced issuer processors come equipped with tools to detect and prevent fraud. They analyze transaction patterns and flag any unusual activity, helping to prevent fraudulent transactions and protect your account.

- Streamlined Card Management: Managing cards becomes easier with an issuer processor. It simplifies tasks such as issuing new cards, updating account information, and providing customer support. This leads to a smoother experience for both banks and cardholders.

- Enhanced Customer Experience: Faster transaction processing and better security contribute to a more satisfying experience for cardholders. This can lead to greater customer satisfaction and loyalty, as users feel confident and secure while using their cards.

- Cost Savings: By improving efficiency and reducing the risk of fraud, issuer processors help financial institutions save money. They minimize errors and losses, and streamline administrative tasks, leading to overall cost savings.

Also read: How many Threads can a Quad-core Processor Handle at Once – A Complete Guide!

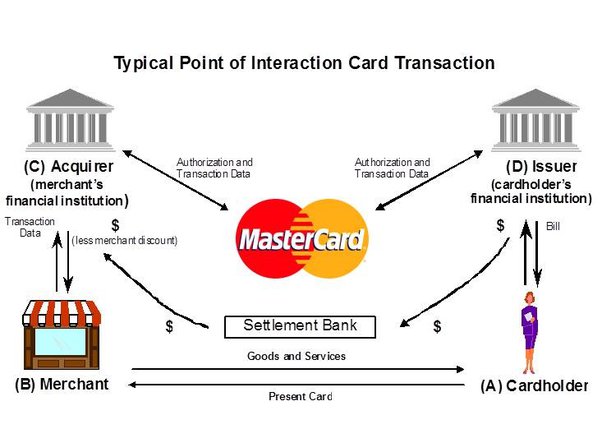

How Payment Processing Works:

Payment processing involves several key steps:

- Authorization: When you make a purchase, the issuer processor checks with your bank to verify that your account has enough funds and that the transaction is valid. This step ensures that you can complete your purchase without any issues.

- Settlement: After your transaction is authorized, the money is transferred from your account to the merchant’s account. This step completes the payment process and ensures that the merchant receives the funds for your purchase.

- Clearing: This step involves exchanging transaction details between banks to reconcile and settle the payment. It ensures that all financial records are accurate and up-to-date.

- Funding: The final step is when the merchant receives the payment, and your account is debited for the amount of the transaction. This completes the payment process and updates your account balance.

What is the Difference Between an Issuer Processor and an Acquirer Processor:

While issuer processors and acquirer processors both play crucial roles in payment processing, they serve different functions:

- Issuer Processor: This processor deals with the cardholder’s bank. It manages the cardholder’s account, authorizes transactions, and handles various card management tasks.

- Acquirer Processor: This processor works with the merchant’s bank. It processes transactions from the merchant’s side, ensuring that the funds are transferred from the cardholder’s account to the merchant’s account.

In simple terms, issuer processors handle the cardholder’s bank, while acquirer processors deal with the merchant’s bank.

What US Companies Provide Issuer Processing Capabilities:

Several companies in the US specialize in issuer processing:

- FIS: FIS provides a wide range of issuer processing services, including transaction processing and fraud management. They offer technology solutions that help banks manage their card programs effectively.

- Fiserv: Fiserv offers comprehensive issuer processing solutions with advanced features for fraud detection and analytics. Their services help financial institutions improve their payment processing operations.

- JPMorgan Chase: As a major financial institution, JPMorgan Chase provides issuer processing services as part of its broader payment solutions. They offer a range of tools to manage card transactions and account information.

- Visa and Mastercard: While primarily known for their card networks, Visa and Mastercard also provide issuer processing services through their affiliated partners. They offer solutions to help banks and financial institutions manage cardholder transactions and data.

The Key Components of Card Issuer Processing:

Key components of card issuer processing include:

- Card Management System: This system manages the entire lifecycle of a card, from issuance to account maintenance. It helps with tasks like activating new cards, updating account details, and handling customer service requests.

- Transaction Authorization Engine: This component processes and authorizes transactions in real time. It checks with the cardholder’s bank to ensure that funds are available and that the transaction is valid.

- Fraud Detection System: Advanced systems monitor transactions for signs of fraud. They analyze transaction patterns and alert banks to any suspicious activities, helping to prevent fraudulent transactions.

- Data Security Infrastructure: Ensures the protection of sensitive cardholder information. It includes measures for secure data transmission and storage, protecting against unauthorized access and breaches.

- Reporting and Analytics: Provides insights into transaction trends, fraud patterns, and overall processing performance. These tools help financial institutions understand their operations and make informed decisions.

FAQ’s:

1. What does an issuer processor do?

An issuer processor manages credit and debit card transactions, including authorization, card management, and data security.

2. How does payment processing work?

Payment processing involves authorization of the transaction, settlement of funds, clearing of transaction details, and funding the merchant’s account.

3. What is the difference between an issuer processor and an acquirer processor?

An issuer processor handles the cardholder’s bank transactions, while an acquirer processor deals with the merchant’s bank transactions.

4. What are the benefits of using an issuer processor?

Benefits include efficient transaction processing, improved fraud detection, streamlined card management, enhanced customer experience, and cost savings.

5. Which US companies provide issuer processing services?

Notable US companies include FIS, Fiserv, JPMorgan Chase, Visa, and Mastercard

Conclusion:

Issuer processors are essential for managing credit and debit card transactions. They streamline transaction processing, enhance security, and improve card management. Understanding the role and benefits of issuer processors can help financial institutions provide better services to their customers and operate more efficiently.